PTS Services, LLC

Data is the root of all business transactions and technology is how to manage and process it. See the skills and expertise PTS will provide your organization.

Our ExpertisePTS Services, LLC

With decades of experience in all areas of taxation, PTS Services provides long and short-term assignments for Fortune 500 companies, established firms and start-ups. Contact us to find out how we can assist your company.

Contact Us

About

PTS Services

PTS Services is a national tax service firm who understands the dynamic environment corporate tax departments face in an ever-changing landscape. Evolving technologies, new legislative and regulatory mandates, resource realignment and data optimization generate additional challenges and opportunities for a department already stretched to the limit. We provide skilled resources with diversified backgrounds and expertise who are available to assist with your global tax life cycle.

Company History

Our core perspective is to centralize data, technology, resources, and process into a comprehensive tax lifecycle encompassing provision, compliance, audit, and planning. With over 20 years of experience working with Fortune 500 companies utilizing technology and streamlining processes PTS Services has the proven experience to be an integral part of your global tax life cycle’s ultimate success.

Flexible Support When you need it the most

We provide highly qualified corporate tax professionals on a flexible loan staff basis to augment your team during peak workloads, tight deadlines, or complex projects. Our specialists integrate seamlessly into your operations to support compliance, tax provision, audits, and system implementations to ensure efficient management of your tax functions.

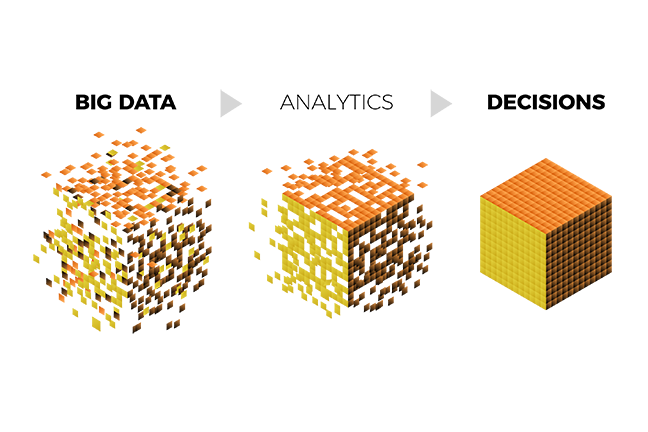

Data

We value a diverse workforce and encourage innovative approaches. Our resources have decades of specialty and practical experience with Fortune 500 companies ranging from Manufacturing, Retail and Holdings, Personal Health and more. We have proven success with remote resource engagements as well as on site staffing.

- Analytics & Automation: Unlock actionable insights through advanced analytics and streamlined processes.

- Data Warehouse: Establish a centralized, scalable platform for all tax data.

- Legacy Data Integration: Modernize and seamlessly integrate historical systems.

- Processing Controls: Ensure robust data integrity and compliance.

Technology

Technology has become the infrastructure to all corporate functions. We understand the dynamic environment that tax departments face in an ever-changing landscape. PTS Services specializes in working with our clients to development department-wide strategies to achieve specific goals by utilizing technology and streamlining the process to attain tangible efficiencies.

- Vendor Selection Consulting

- Client-specific Alteryx Workflows

- Existing Alteryx Workflow Management and Training

- Automation Evaluation

- Automation Value Assessment

- Tax Software Implementation

- Data Management Software Implementation

Resources

With ability to work remote or on-site, our resources have decades of specialty and practical experience. We work with corporate tax subject matter experts to help companies with worldwide tax difficulties. PTS will transform your tax department and increase your organization's impact.

- ASC 740, Federal & State Tax Compliance and Financial Statement Support

- Direct & Indirect Tax Compliance

- Nexus Study / VDA

- Revenue Agent Report (RAR) Support - Federal & State

- Tax Credit Strategy (Statutory & Negotiated) - Federal, State & International Incentives (Including R&E and Additional Credits)

- Comprehensive SOX Compliance: In-depth Evaluation, Process Enhancement, and Rigorous Testing

- E-Filing

- IRS, State & International Audit Support

- Transfer Pricing (Sec. 482),Intercompany Pricing & Product True-Ups

- Country-by-Country (BEPS) Compliance Reporting

- Pillar Two & GMT Tax

Process

PTS will inspire the tax function by connecting people, leveraging resources, and driving innovation. Utilizing an integrated approach, we analyze your current process to determine best practices and improvements tailored to your specific needs. Our assessment analysis includes:

- Collect all data sources and providers

- Determine the existing technology applications used (Excel, external applications, others)

- Map the process flow for each tax function workstream

- Identify repetitive, manual, and disconnected streams

- Determine business obstacles to process changes

- Deliver suggestions for improvements, automation, and necessary resources to implement

- Vertex Data Warehouse Implementation.

- Corptax Compliance Software Implementation.

- Indirect Tax Compliance Software Implementation.

- International Tax Planning including GILTI/FDII Analysis.

- Transfer Pricing Software Implementation.

- Research and Experimental Tax Credit Software.

- Automated 5471 Reconciliations.

- ODBC Automated Data Streams.

- Develop Alteryx workflows to increase efficiency and accuracy as well as alleviate data processing bottlenecks.

- Provide use case scenarios and value-added scenarios on various products.

- Determine cross function technology applications.

- Form personal and specific technology training to your organization’s technology skill level and needs.

- Analyze product life cycle and determine an ROI.

- Ascertain your technology pain points or obstacles.

- Identify applicable products on the market.

- Determine proper process or vendor managed solutions.

- Formulate budget and internal rate of return calculation.

- Suggest the best solution, manual or automated

- Preparing specific project work plans which includes all key milestones and delivery dates.

- Ensuring support for the plan from client and vendor team members.

- Scheduling kick off meetings and necessary first steps.

- Closely monitoring expected project delivery dates.

- Clearly communicating status and adherence to the work plan.

- Being agile as client needs change during implementation.

- Developing testing environments and application trials.

- Ensuring needed IT internal control standards are understood and met.

- Delivering the live environment as expected

- Develop or offer suggestions with a request for quote (RFQ)

- Ensure the RFQ is thorough and highlights the results to be delivered.

- Prepare a list of vendors and present the best options.

- Schedule vendor demonstrations and proposed agendas

Why choose us

With years of corporate tax experience, PTS professionals are proficient with corporate tax applications. We can implement and configure your system the right way the first time. Our integrated approach analyzes your current system to identify best practice improvements.

We do what is right.

We do it right.

We implement the right changes.

Тhe numbers are proof of

our achievements

Projects Completed

Awards

Trusted Clients

Expert Advisors

PTS Services is committed to putting our employees at the forefront of opportunity. We understand the value of a diversified workforce and strive to build relationships that allow our employees to grow their career. We are a highly efficient team, and our integrity and effectiveness show in our results. We offer opportunities from internships to senior level positions.